aurora sales tax rate 2021

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax.

Kansas Sales Tax Rates By City County 2022

2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County.

. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. Method to calculate Aurora sales tax in 2021. 0375 lower than the maximum sales tax in MO.

This new rate structure will have little to no impact on approximately 80 of customers. Filing after the due date will result in the loss of the discount plus the assessment of a penalty of 75 and interest at 125 per month. Aurora 44202 Portage 700.

Did South Dakota v. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. This increase and extension became.

This is the total of state county and city sales tax rates. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 3 Cap of 200 per month on service fee.

Five other citiesFremont Los Angeles and Oakland California. The Aurora sales tax rate is. City of Aurora 25.

24 lower than the maximum sales tax in CO. This is notan all inclusive list. For tax rates in other cities see Colorado sales taxes by city and county.

The City Code also requires that payment of the tax be made before the end of the month following the monthperiod for which the tax has been filed. The County sales tax rate is. The current total local sales tax rate in Aurora IL is 8250.

This is a. Tax Rate Changes Modifications. Timely filers are entitled to a 21 discount.

This is the total of state county and city sales tax rates. Effective January 1 2007 the Adams County Sales Tax rate increased from 07 percent to 075 percent. The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities.

The aurora colorado general sales tax rate is 29. For tax rates in other cities see Missouri sales taxes by city and county. 1281 per month service charge.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. This tax is equal to 025 on every 100 spent. Below you can find the general sales tax calculator for Aurora city for the year 2021.

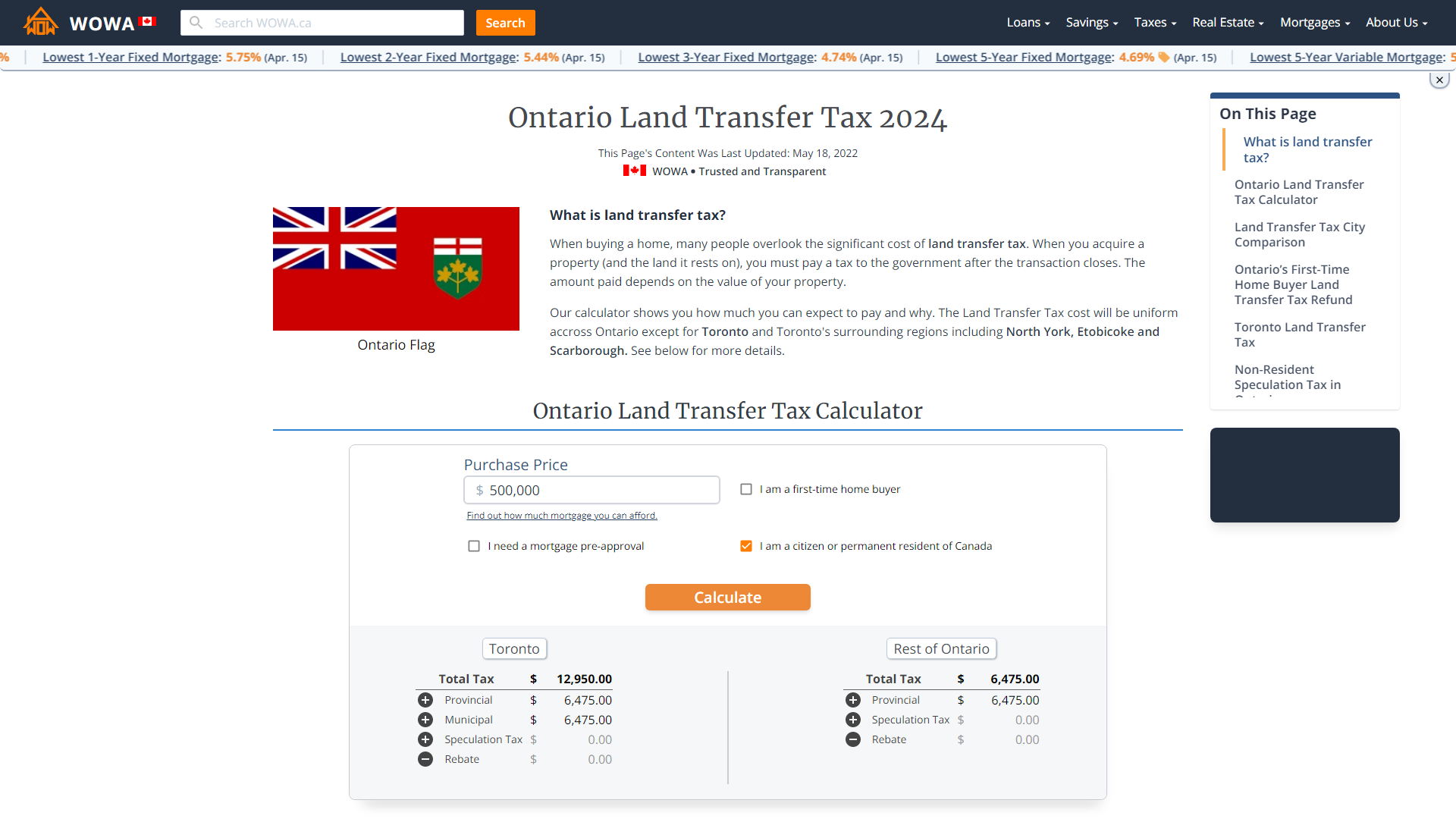

Aurora Sales Tax Rates for 2022. Aurora property tax rates are the 9th lowest property tax rates in Ontario for municipalities with a population greater than 10K. The current total local sales tax rate in Aurora CO is 8000.

You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. POST OFFICE ZIP CODE COUNTY RATE POST OFFICE ZIP CODE COUNTY RATE PAGE 2 REVISED January 1 2021 Dennison 44621. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL.

The County sales tax rate is. What is the sales tax rate in Aurora Colorado. Wayfair Inc affect Nebraska.

Choose the Sales Tax Rate from the drop-down list. And Seattle Washingtonare tied for the second highest rate of 1025 percent. Depending on local municipalities the total tax rate can be as high as 112.

Friday January 01 2021. Download all Colorado sales tax rates by zip code. Most customers use only around 5000 gallons or less during the winter and between 7500 and 8000 gallons per month annually.

The City of Auroras tax rate is 9225 and is broken down as follows. The Nebraska sales tax rate is currently. There is no applicable special tax.

The Aurora sales tax rate is. You can print a 9225 sales tax table here. The Aurora Sales Tax is collected by the merchant on all.

Did South Dakota v. The minimum combined 2022 sales tax rate for Aurora Nebraska is. Birmingham Alabama at 10 percent rounds out the list of.

4 Sales tax on food liquor for immediate consumption. The December 2020 total local sales tax rate was also 8000. 100 Working Flint City sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes.

You can print a 85 sales tax table here. Aurora-RTD 290 100 010 025 375. Check your city tax rate from here.

On November 2 2004 voters approved a ballot issue to increase the existing Open Space Sales Tax from 02 percent to 025 percent and extend the tax until December 31 2026. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2.

2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Effective December 31 2011 the Football District salesuse tax. Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month.

Wednesday July 01 2020. What is the sales tax rate in Aurora Nebraska. City Final Tax Rate.

1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. This new tier structure will be in effect beginning January 1 2021. The minimum combined 2022 sales tax rate for Aurora Colorado is.

The minimum combined 2021 sales tax rate for aurora colorado is 8. Best 5-Year Variable Mortgage Rates in Canada. Wayfair Inc affect Colorado.

The Colorado sales tax rate is currently. Austinburg 44010 Ashtabula 675. 2021 Tax rates for Cities Near Aurora.

The Aurora Sales Tax is collected by the merchant on all qualifying sales. 5 Food for home consumption. Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent.

The December 2020 total local sales tax rate was also 8250. The average sales tax rate in Colorado is 6078.

Who Pays The Least Property Tax In Ontario The Answer May Surprise You Alex Irish Associates

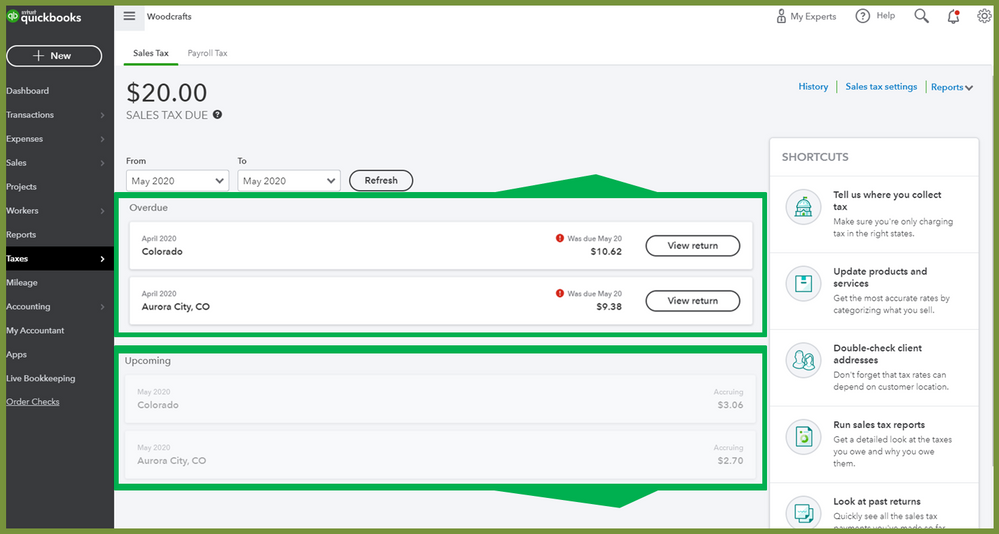

Set Up Automated Sales Tax Center

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

Nebraska Sales Tax Rates By City County 2022

Sales Tax By State Is Saas Taxable Taxjar

Set Up Automated Sales Tax Center

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Calculate Cannabis Taxes At Your Dispensary

Set Up Automated Sales Tax Center

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com