property tax forgiveness pa

Rated Number One For Businesses. Move down the left-hand side of the table until you come to the.

City Real Estate Property Taxes are based on a calendar year from January 1 thru December 31 of the current year.

.jpg)

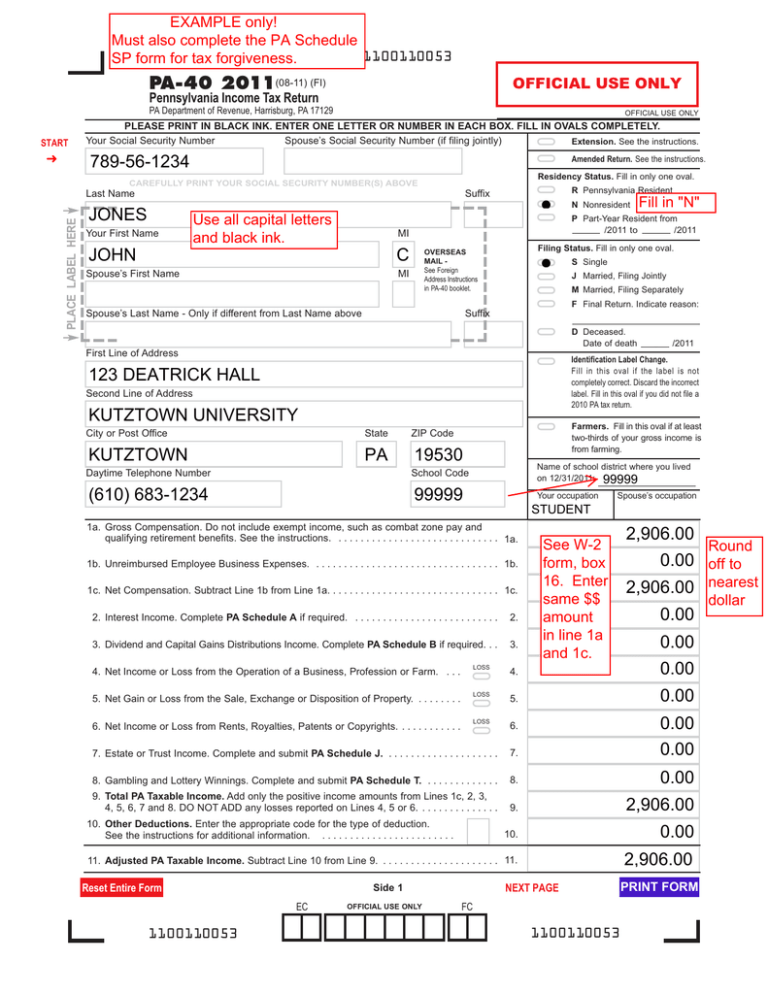

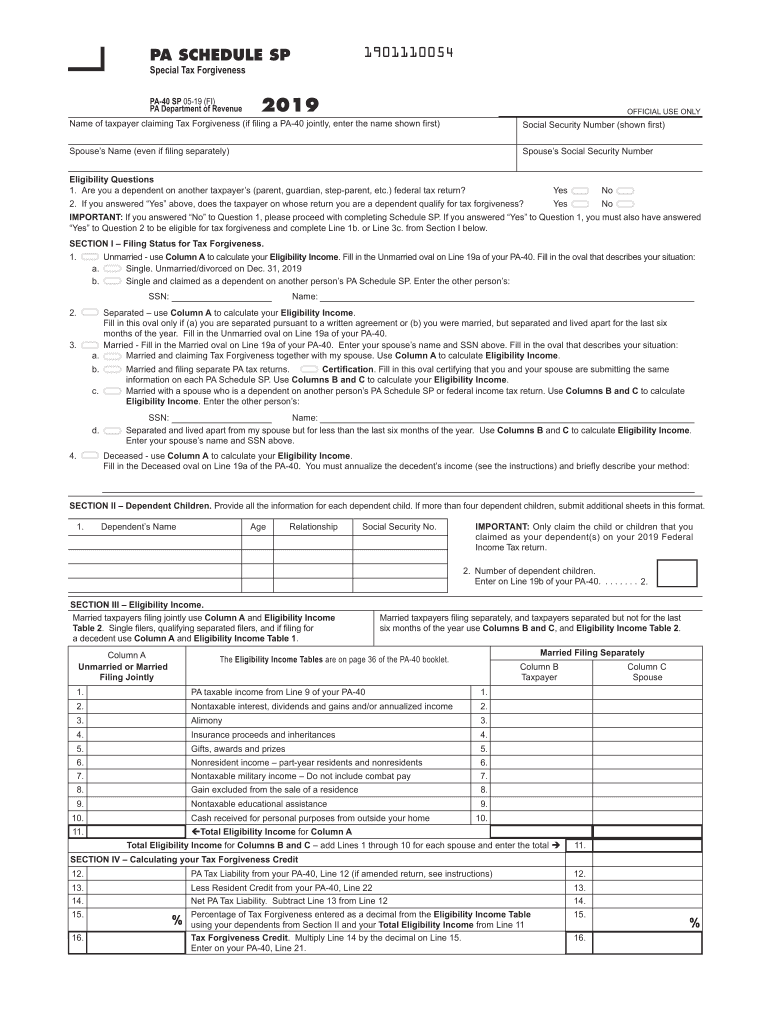

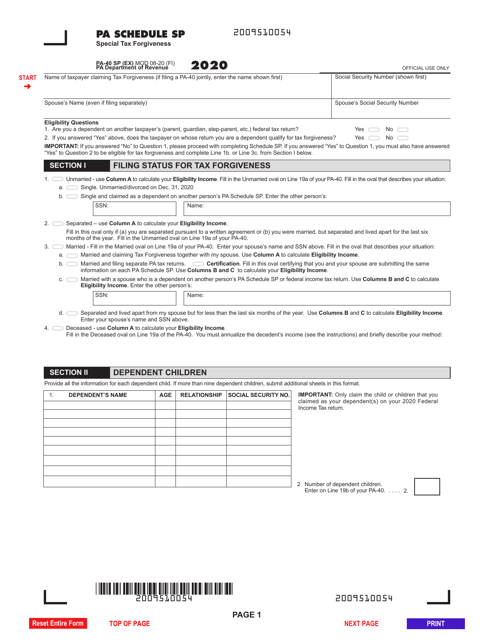

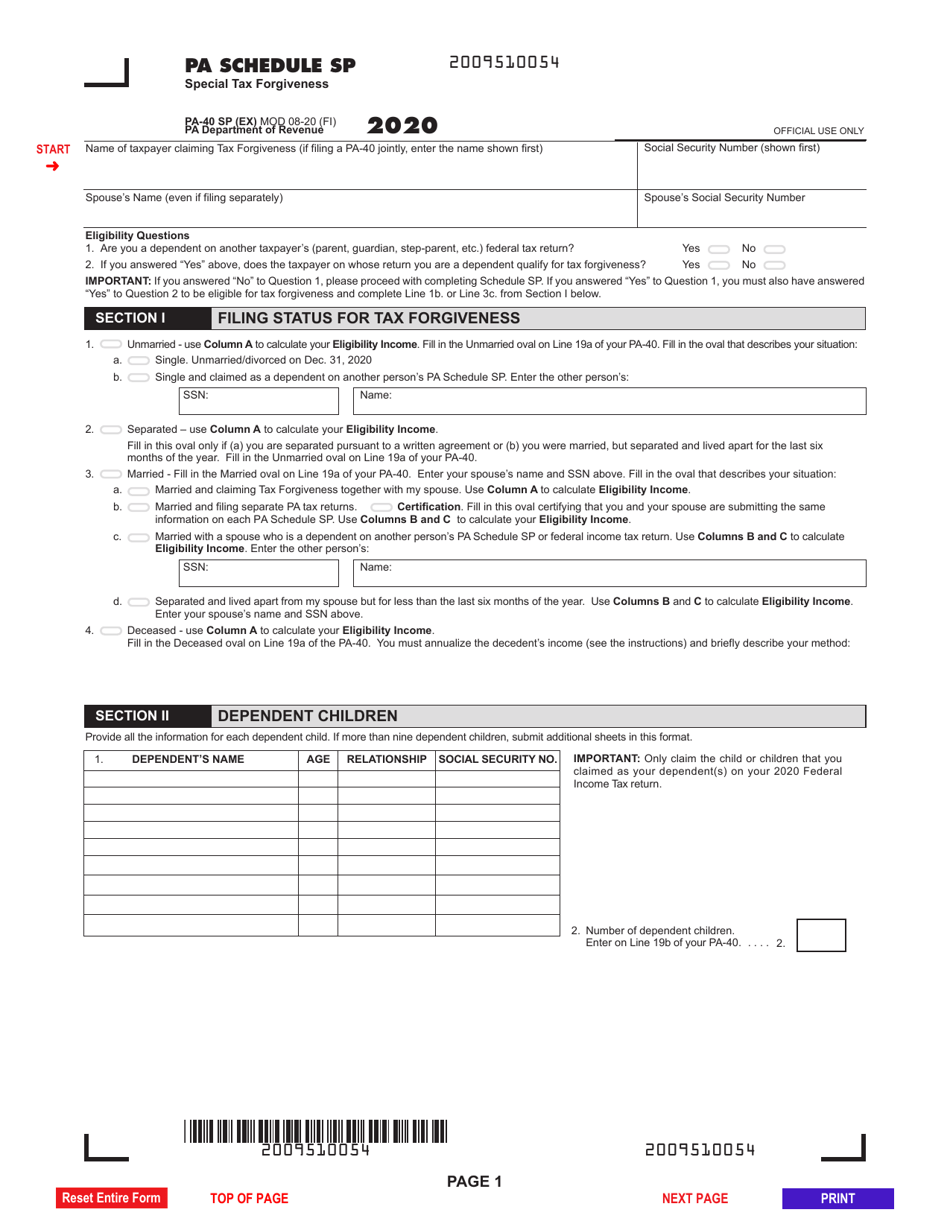

. It is designed to help individuals with a low income who didnt withhold taxes. To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return. Hubert Minnis Prime Minister Minister of Finance announced the Governments immediate.

We Offer A Free IRS Transcript Report Analysis 499 Value. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Rated Number One For Businesses.

Property Tax Penalty Forgiveness - Cherry Township PA Property Tax Penalty Forgiveness Posted on December 8 2020 The penalty for real estate taxes was forgiven. A The Commission will review cases that have been granted real property tax relief. Book A Consultation Today.

The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. The level of tax forgiveness is based on the income of the taxpayer and. Real Estate Tax Exemption The program provides real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has a financial.

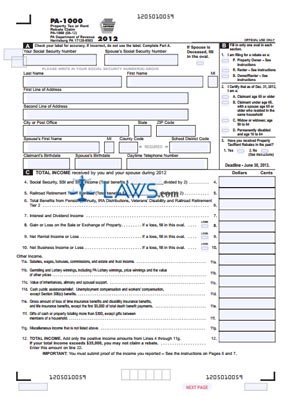

Heres what you need to know about the Property TaxRent Rebate Program in Pennsylvania Pennsylvania News readingeagle What is the Homestead Exemption in Real Estate. States also offer tax forgiveness based on personal income standards. The assistance is through the state Property TaxRent Rebate Program which was founded in 1971 and has delivered over 68 billion to eligible Pennsylvanians since its.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Of course the homeowner must have been delinquent on paying their property taxes and it usually needs to be a recent issue and hardship that the person is facing. If you are filing as Married use Table 2.

Provides a reduction in tax liability and Forgives. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. Ad Suffering From Tax Problems.

Pay your bill on or before the discount date in April -. These standards vary from state to state. Code 524 relating to processing applications.

If you are filing as Unmarried use Table 1. Ad Suffering From Tax Problems. Consult With ECG Tax Pros.

Begin Main Content Area Tax Forgiveness. Tax amount varies by county. PA Schedule SP Eligibility Income Tables.

Book A Consultation Today. Many Pennsylvanians who may be eligible for a refund or reduction of their Pennsylvania personal income taxes will be receiving. Consult With ECG Tax Pros.

Insurance proceeds and inheritances- Include the total proceeds received from life or. 135 of home value. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners as well as disabled veteran homeowners or their surviving spouses.

The homeowner will need to. Will be used to review and determine your eligibility for exemption for real property taxes under Article 8 Section 2c of the Pennsylvania Constitution and 51 PaCS. This section cited in 43 Pa.

For example in Pennsylvania a single person who makes. On 1 March 2021 during the Fiscal Strategy Debate the Most Honourable Dr. We Offer A Free IRS Transcript Report Analysis 499 Value.

Free Form Pa 1000 Property Tax Or Rent Rebate Claim Free Legal Forms Laws Com

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

So That S What It Takes To Get A Little Property Tax Relief Editorial Cartoon Pennsylvania Capital Star

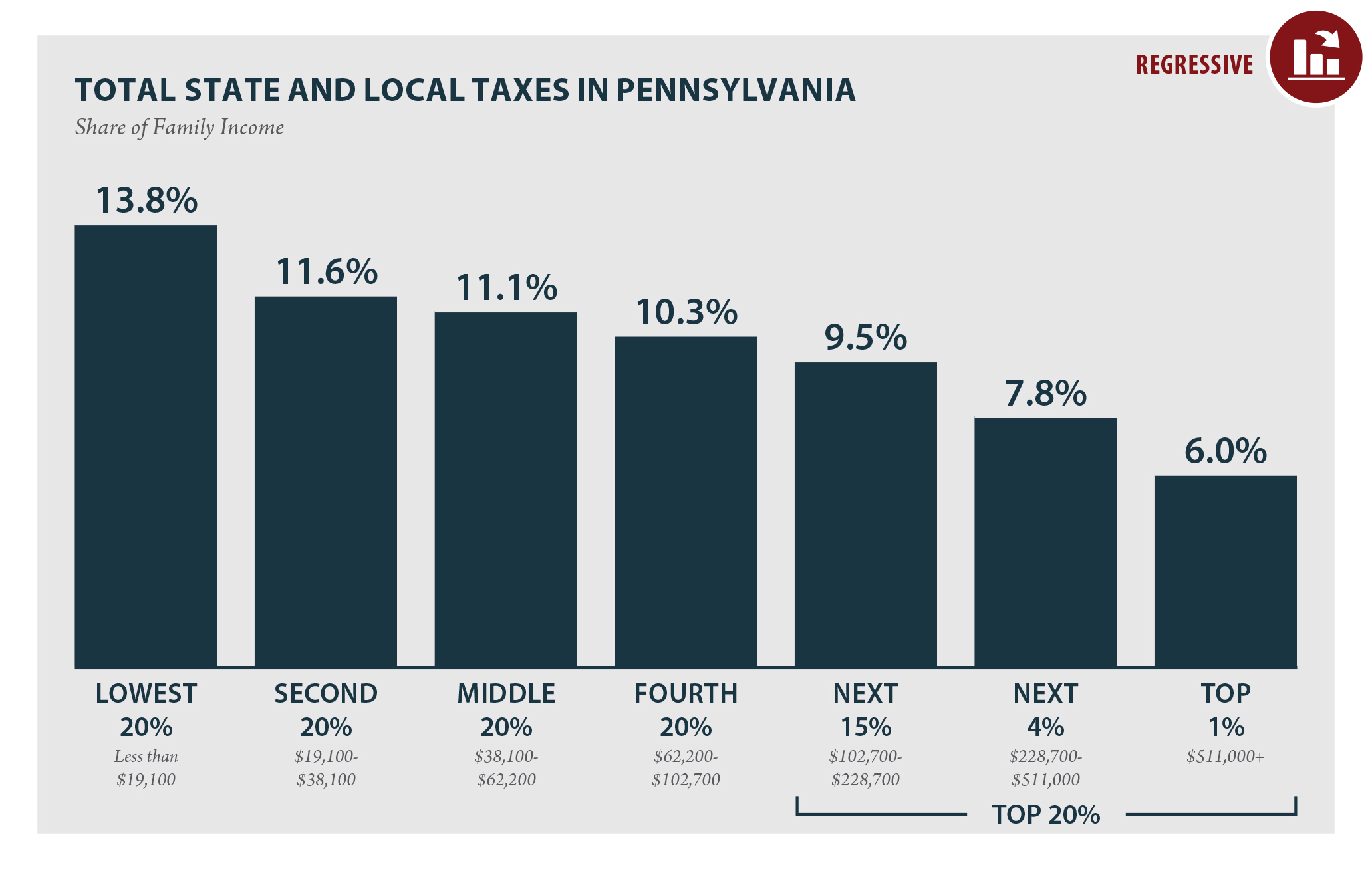

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

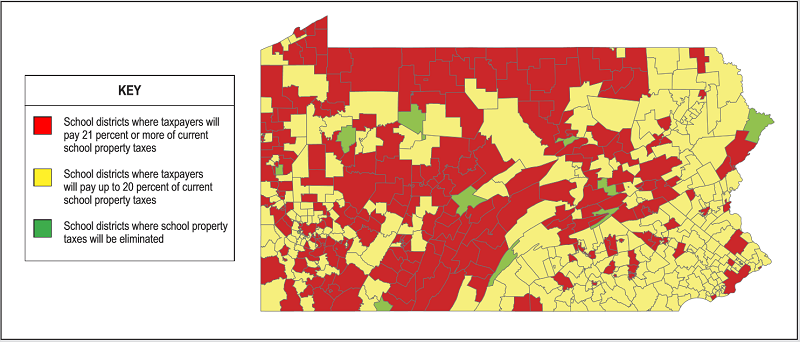

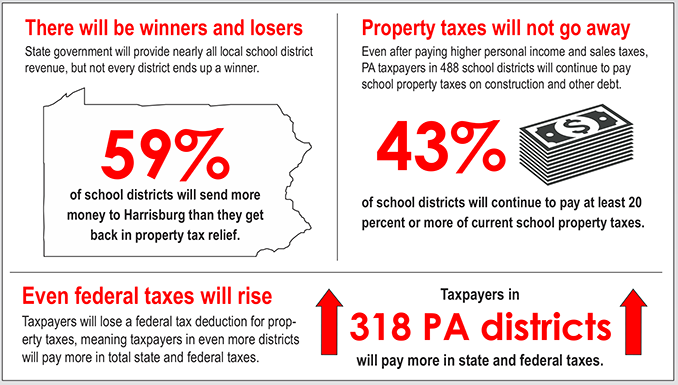

Property Tax Bill Will Cost Pa Taxpayers More

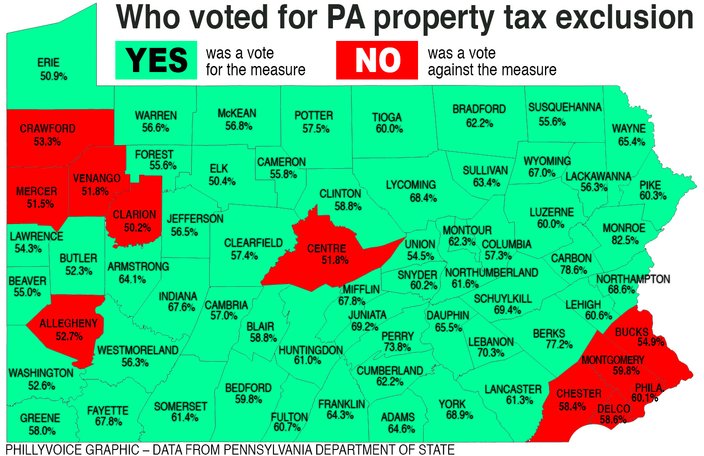

Map Here S Who Voted For Property Tax Exclusion In Pennsylvania Phillyvoice

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Pennsylvania Who Pays 6th Edition Itep

Get And Sign Pa 1000 Form 2018 2022

Property Tax Bill Will Cost Pa Taxpayers More

Pa Budget Battle Is Covid Relief Money The Cure For Property Tax Rates Gop Says No Dems Say Yes Pittsburgh Post Gazette

.png)